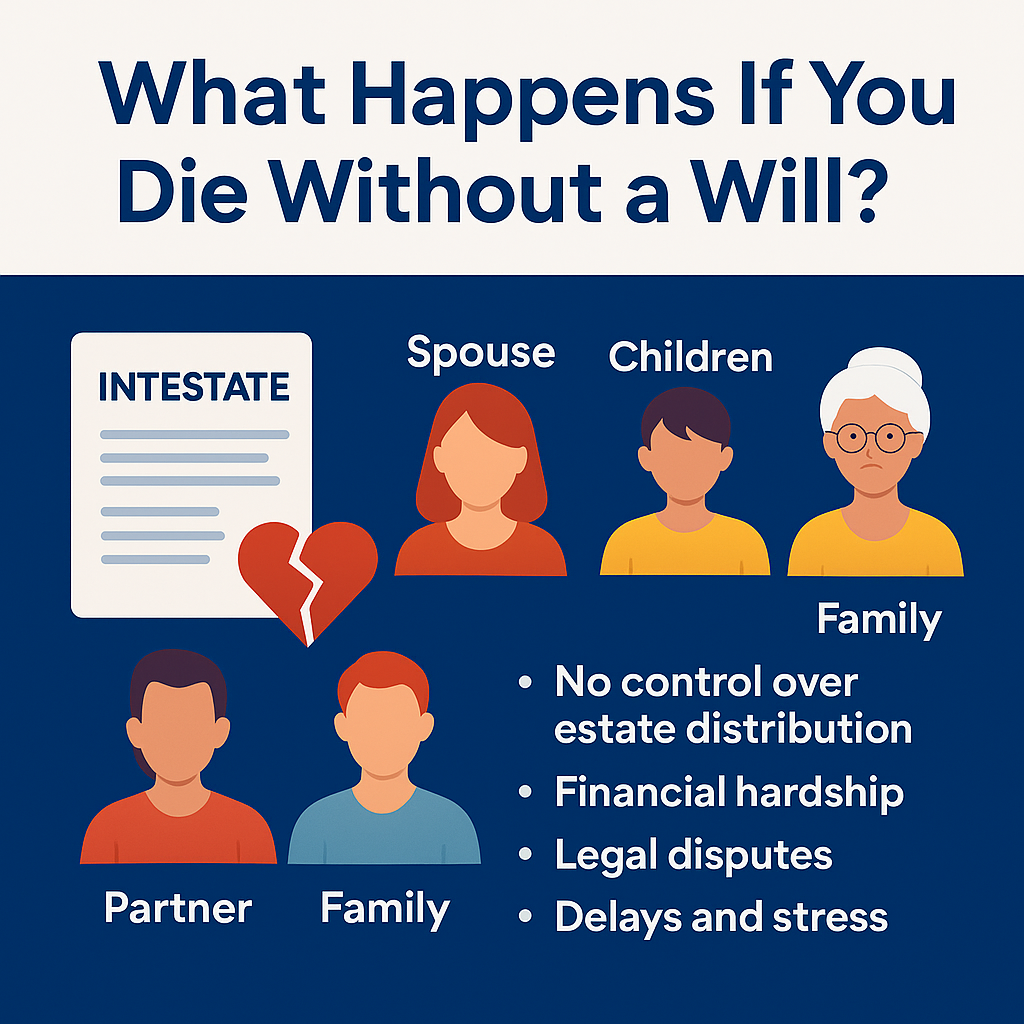

What Happens If You Die Without a Will? The Real Cost of Dying Intestate

Creating a Will is one of the most important things you can do to protect your loved ones and ensure your wishes are respected. Yet, a surprising number of people in the UK still pass away without one. This is known as dying intestate—and it can lead to complications, costs, and stress for the family left behind.

In this blog, we’ll walk through what it really means to die intestate, how your estate is handled in the absence of a Will, and why putting your Will in place is a decision your future self (and family) will thank you for.

What Does It Mean to Die Intestate?

Dying intestate means passing away without a legally valid Will in place. In the UK, when someone dies intestate, their estate—everything they own—must be distributed according to the rules of intestacy, rather than their personal wishes.

These rules follow a strict hierarchy that prioritises close family members. Unfortunately, they do not take into account personal relationships, wishes, or family dynamics.

What Happens to Your Estate?

- An administrator is appointed (often a close relative), instead of an executor you would normally name in a Will.

- The intestacy rules determine who inherits your money, property, and belongings.

- Unmarried partners, stepchildren, and friends receive nothing, even if they were part of your daily life.

The Emotional and Financial Toll on Loved Ones

Dying intestate doesn’t just create confusion—it can lead to:

- Family Disputes

If your wishes weren’t written down, surviving relatives may disagree over who should receive what, leading to arguments or legal battles. - Legal Delays

The process of applying for administration without a Will can take longer and be more complex, delaying access to much-needed funds. - Extra Costs

Without clear instructions, your estate may incur higher legal fees, taxes, or require court involvement to sort out inheritance claims. - Missed Opportunities to Protect Vulnerable People

If you have children under 18, the court may decide who cares for them. If you planned to leave money for someone with disabilities or in financial hardship, those plans will not be honoured without a Will.

Who Gets What Under Intestacy Rules (England & Wales)?

Here’s a simplified breakdown:

- Married or Civil Partner (with children): Your spouse gets the first £322,000 and half the remainder; the other half goes to your children.

- Married or Civil Partner (no children): Your spouse inherits everything.

- Unmarried Couples: Your partner receives nothing—regardless of how long you’ve been together.

- No Immediate Family: Your estate could end up going to distant relatives… or even the Crown.

The Benefits of Having a Will

- Choose exactly who inherits your assets

- Appoint guardians for your children

- Leave gifts or donations to charities

- Protect vulnerable beneficiaries with trusts

- Minimise inheritance tax

- Avoid disputes and delays

How to Get Started

Whether you’re starting from scratch or reviewing an outdated Will, we’re here to help.

Book a Free Will Review With Us

At Callaghan Wills & Estate Planning, we offer a free, no-obligation Will review to make sure your current Will is still working for you.

💡 We’ll help you spot gaps, identify risks, and recommend whether you need a simple update – or a more comprehensive plan involving Trusts or Lasting Power of Attorney.

✅ Peace of mind doesn’t cost a thing.

Adhering to UK Law for your Benefit

Our approach aligns with UK law to maximise your gain economically, all while upholding the highest standard.

We are committed to the highest levels of service and adhere to a strict Code of Conduct – your guarantee of a quality and a professional service.

All of our work is double-checked, and we also carry a substantial level of Professional Indemnity Insurance for your added peace of mind.

GET IN TOUCH

Contact our friendly team and we will arrange your no obligation home visit. We can visit at a time that suits you, or you can book a Zoom call if you prefer.

MEET WITH OUR EXPERTS

During your appointment, we’ll listen to your wishes and discuss your options. We ensure you have a thorough understanding of the whole process.

YOUR WILL PRESENTED

Following your approval your documents are presented to you for signing with full instructions, then your final documents should be with you within 2-3 weeks.

FREE Review of Your Existing Will

If you have any questions, book a free call with us and check out our Frequently Asked Questions – FAQ’s